Embracing the Unpredictable

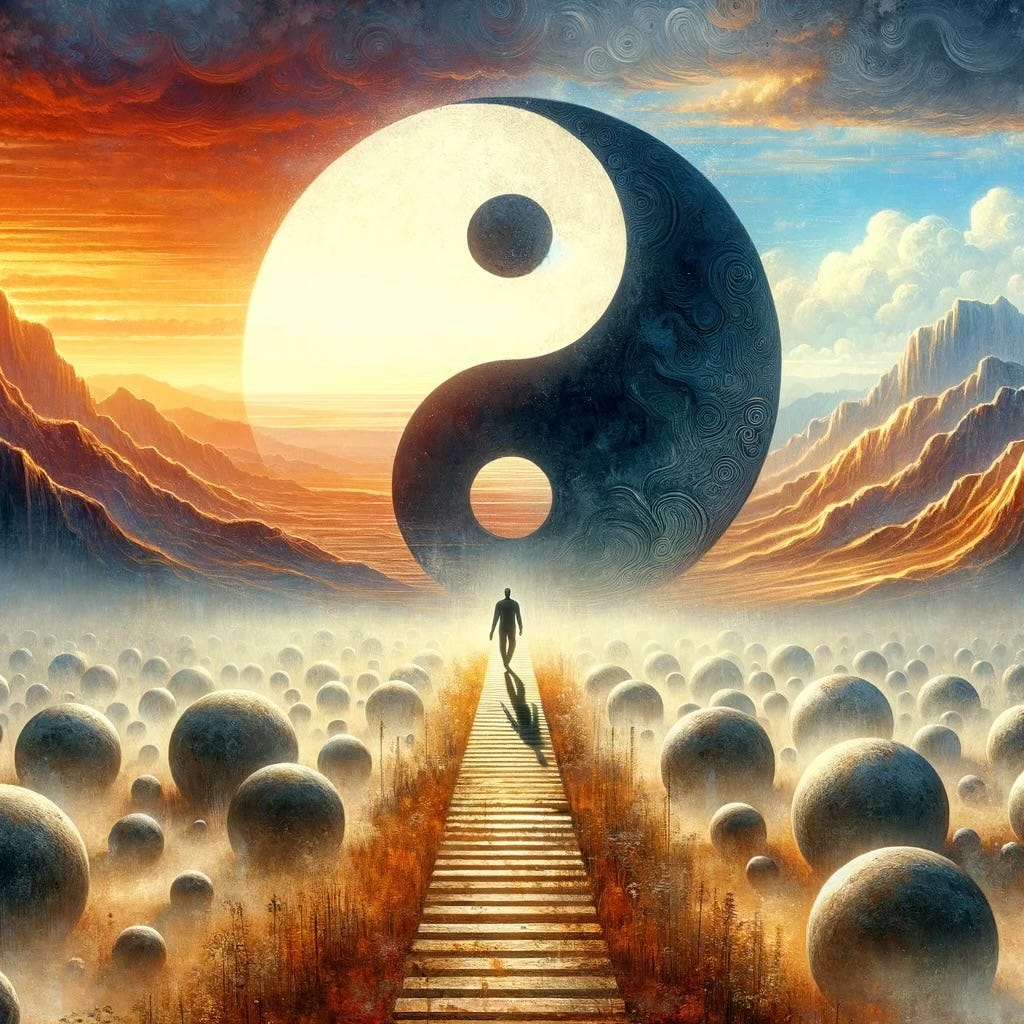

Ancient Wisdom and Modern Insights For Journeying Through Financial Chaos

In the labyrinth of today’s financial world, where uncertainty is the only certainty, we stand at the precipice of a reality that demands not only caution but a profound understanding of the forces at play.

For growing numbers of us, including myself, there is no margin for error when it comes to personal finances. In other words, the cost of a misstep is disproportionately high.

Our journey through these tumultuous times is not only a test of financial acumen but a profound philosophical exploration, one where Taoist and Stoic wisdom, alongside insights from thought-leader Nassim Nicholas Taleb, can help illuminate our path.

From a Taoist perspective, the principle of Wu Wei, or non-action, offers a paradoxical strategy for navigating financial uncertainties. Rather than passivity, it suggests a form of action that is in harmony with the natural flow of events.

Imagine floating down a river; you can struggle against the current, exhausting yourself while making scant progress. Or you can steer gently, conserving energy and using the river’s own power to guide you.

In financial terms, this means not reacting impulsively to market volatility but adopting a strategy that aligns with the broader trends, recognizing that the forces at play are often beyond individual control.

Stoicism, on the other hand, can arm with the fortitude to face the inherent unpredictability of financial markets. It teaches the value of focusing on what is within your control—your reactions, your decisions, and your preparations.

The Stoic practice of negative visualization, where one contemplates potential losses or setbacks, is not an exercise in pessimism but a tool for emotional and practical readiness. By acknowledging the worst-case scenarios without fear, you become immune to the paralyzing effect of unexpected downturns, equipped to make reasoned decisions amidst chaos.

Nassim Nicholas Taleb's contributions to understanding randomness and uncertainty further enrich this philosophical toolkit. His concept of "antifragility" is particularly relevant; it goes beyond resilience or robustness. An antifragile system thrives on chaos, improving with exposure to volatility and uncertainty.

In your financial endeavors, adopting an antifragile approach means creating a portfolio not just to withstand shocks but to benefit from them. It's about positioning yourself in such a way that market disruptions become opportunities for growth rather than threats to survival.

Taleb also warns against the "Black Swan" phenomenon—highly improbable events that have massive impacts. The financial crisis of 2008 serves as a stark reminder of how such events can blindside the most confident predictions.

Here, both Taoism and Stoicism converge with Taleb’s insights, advocating for humility in the face of the unknown and the cultivation of systems and mindsets that can adapt and evolve when the unthinkable happens.

So, how do you navigate these uncertain financial times with no margin for error? First, embrace the Taoist principle of Wu Wei by aligning your actions with the natural flow of the financial world, understanding that not all movements require your counteraction.

Next, adopt a Stoic mindset, focusing on what you can control and preparing emotionally and practically for adverse outcomes. And, inspired by Taleb, construct your financial strategies to be antifragile, ready to capitalize on the disorder rather than crumble under it.

But beyond these strategies lies a deeper philosophical inquiry into the nature of uncertainty itself. The acceptance of unpredictability as a fundamental characteristic of life—and the financial markets—can liberate you from the anxiety of trying to forecast the unfathomable. This acceptance doesn’t lead to inaction but to a more nuanced engagement with the world, one that acknowledges the limits of our knowledge and control.

In these uncertain times, the margin for error is indeed nonexistent if you adhere strictly to traditional expectations of success and stability. However, by integrating the wisdom of Taoism and Stoicism with Taleb’s insights on randomness and antifragility, you can redefine what success means in such an environment.

It becomes not about avoiding failure at every turn but about cultivating a mindset and a strategy that allows you to navigate, and even thrive, amid the inevitable ups and downs.

The financial landscape you traverse is fraught with hazards, but it is also ripe with opportunity for those who can see beyond the immediate tumult. By embracing the principles of ancient philosophy and modern thought leadership, you arm yourself against the vicissitudes of fortune, turning what seems like an unforgiving tightrope walk into a journey of growth, learning, and eventual triumph.

Remember, in a world where there's no margin for error, the greatest mistake is to believe we must never err. Instead, let each step, whether deemed right or wrong, be a lesson in the art of navigating the unpredictable, a testament to the power of philosophical resilience in the face of financial storms.